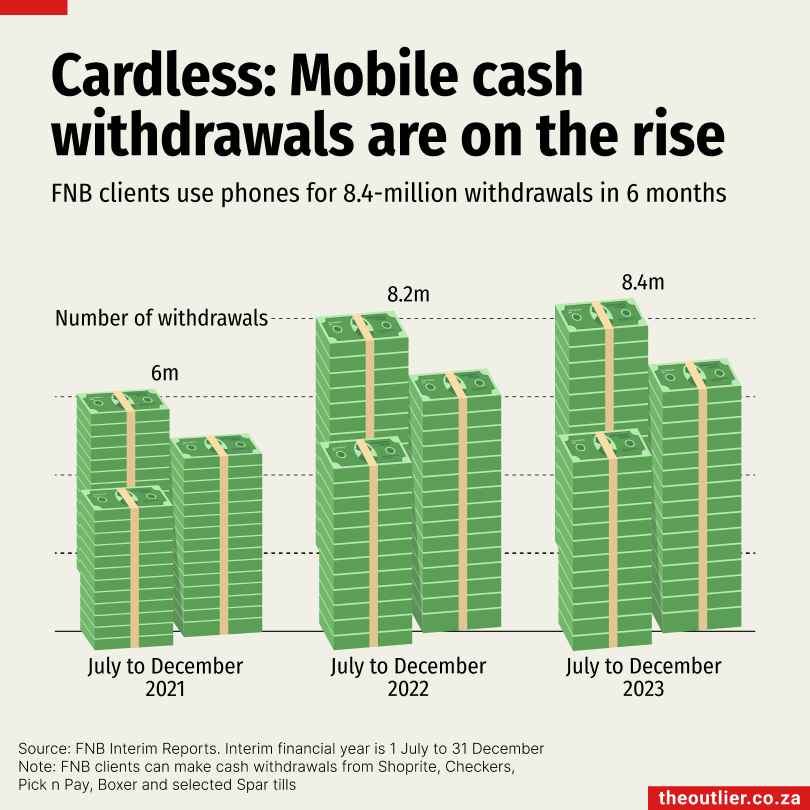

South Africans are increasingly relying on their mobile phones to do their banking. FNB data shows that the number of withdrawals made using mobile phones has increased over two years from 6-million transactions in the last six months of 2021 to 8.4-million in the same period in 2023.

FNB clients can make withdrawals using the banking apps on their phones at ATMs or at selected Spar stores.

Withdrawing cash using a banking app means people do not need to carry a physical bank card. FNB’s default withdrawal limit is R3,000, according to the bank’s website.

Banking apps also make it easier to send money to people without a bank account, as all a person needs to access the cash is the code the bank sends them as an SMS.

Updated: 1 August to specify retailers and withdrawal limit